The Buzz on Regence Medicare Supplement (Medigap)

What Does Find a Medigap policy that works for you - Medicare.gov Mean?

There are three methods in which insurance providers set Medigap rates: With prices, enrollees are charged the very same premium despite age. So a 65-year-old enrollee will pay the exact same premium as an 85-year-old enrollee. Premiums can alter over time, however they change by the very same amount for all enrollees. There are eight states that need all Medigap prepares to be community rated.

So the older the person is at the time of purchase, the higher the premium, and that difference continues as long as they have the plan. For strategies with this score structure, it's particularly essential to enlist as soon as you're qualified for Medicare coverage, since your premium will always be as low as possible that way.

Medicare Advantage Versus Medicare Supplement: How to Choose - Everyday Health

Blog - Medicare Supplement Plans and You - Know Your Options

These strategies may be the least costly choice when you're first eligible for coverage, because you'll be among the youngest enrollees. However as you age, the price will increase based upon your age as well as aspects like inflation and overall medical cost patterns. Know that Medigap strategies in many states are just ensured problem during the six-month window that starts the month you turn 65 (or when you enroll in Medicare Part B, which may be after you turn 65 if you still had employer-sponsored protection), and throughout minimal special registration durations.

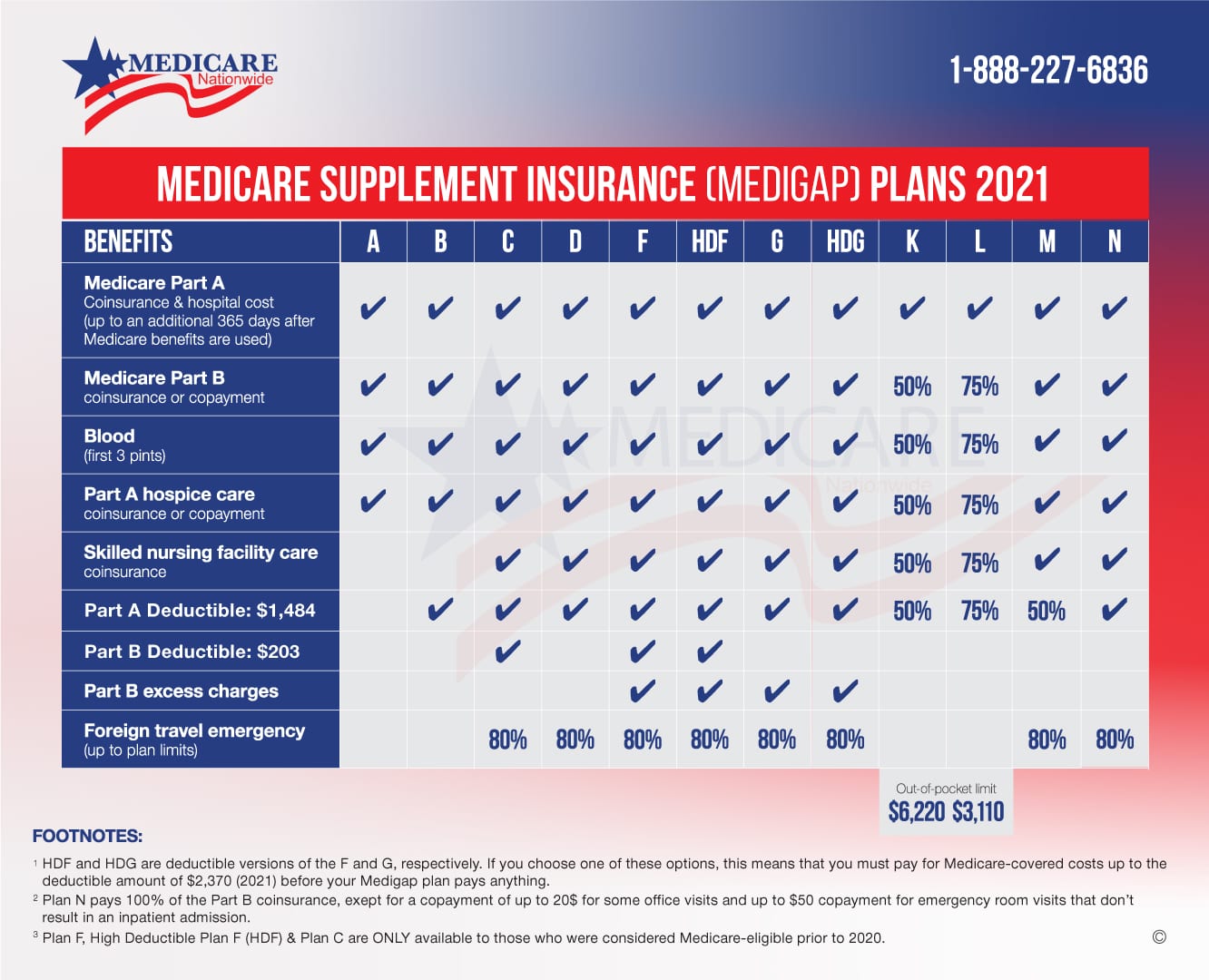

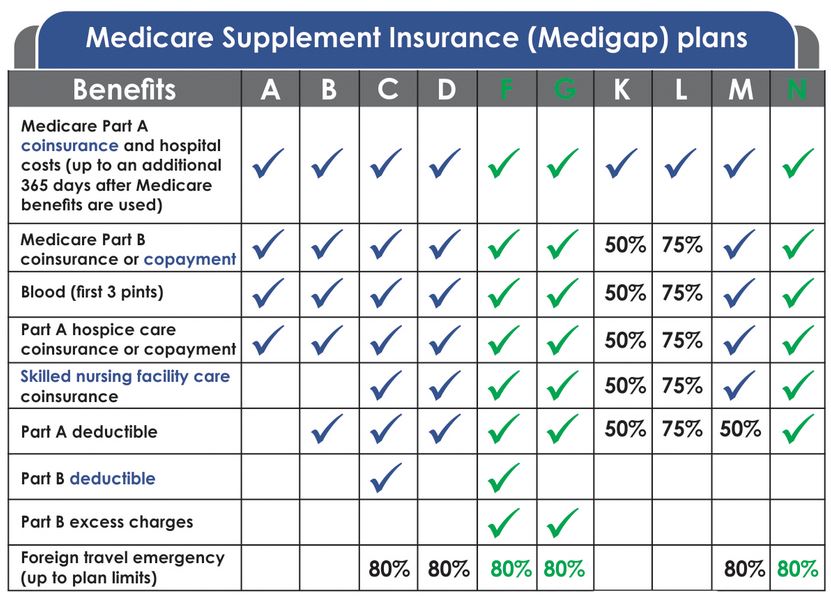

Blog - Medicare Supplement Plans (Medigap) Chart 2018

The Best Strategy To Use For Medicare Supplement Plans and Medigap Quotes

If you don't enlist during your initial enrollment period, you might have to pay a higher premium or be decreased entirely if you're in bad health, as carriers are enabled to utilize medical underwriting after your preliminary registration period has actually passed. How can This Author pay less for Medigap protection? Ensure you enlist as quickly as you're qualified, in order to get protection that's guaranteed concern with no premium rate-ups based upon your case history.

Some insurance providers provide discount rates for females, non-smokers, married individuals, and for paying annually. States also offer a health insurance coverage support program, providing up-to-date Medigap insurance coverage info and a list of competent private insurance providers. Inspect our state pages to find your state's help program. Exists a best time to purchase a Medigap policy? The very best window of time in which to buy a Medigap policy starts on the first day of the month in which you're at least 65 and enrolled in Medicare A and B (you need to be enrolled in both Medicare A and B in order to get a Medigap strategy).